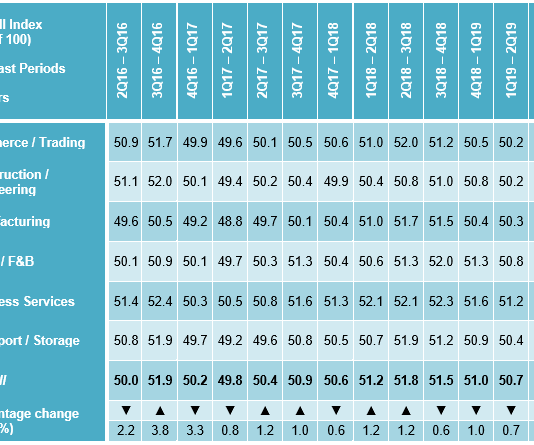

Singapore SMEs continue to adopt a mildly optimistic outlook for the first six months of 2019 as general sentiments eased across all seven sectors.The SBF-DP SME Index (the Index) decreased from 51.0 to 50.7 this quarter, indicating a slight dampening of sentiments among SMEs. This index is...

Business owners of small to medium size enterprises (SMEs) can now purchase commercial insurance tailored to their business needs online with Etiqa Insurance Singapore. The digital insurer has recently launched the Business Owners Super Suite (BOSS), which allows business owners and Etiqa’s agents to get commercial insurance...

Small and medium businesses need to jump on to the mobile payments bandwagon in order

to gain a competitive edge over larger firms.

A recent survey conducted by US-based financial services corporation Visa, indicates that

customers worldwide prefer to pay with credit cards or mobile devices. According to the

survey titled Digital Transformations...

The Singapore Business Federation (SBF) SME Committee (SMEC) submitted its recommendations for the Singapore Budget 2019 to the government earlier this month.In 2018, the Singapore economy grew 3.3%, in line with the Ministry of Trade and Industry’s (MTI’s) forecast of 3.0% to 3.5%. Moving forward, MTI forecasts...

Singapore’s Central Bank, the Monetary Authority of Singapore (MAS), has warned members of the public not to be misled by fraudulent websites that solicit investments in cryptocurrencies using fabricated information attributed to the Singapore Government.

These websites falsely claim that Singapore is adopting a...

HSBC Singapore has launched an exclusive full suite of banking services and tailored solutions to select small and medium enterprises (SMEs).

Operating on a per invitation basis, the accelerator programme titled Pioneer will provide tailored business solutions, flexibility, support and expertise for SMEs who are not able to access banking services...

SeedIn, a Singapore based business financing platform, has teamed up with Acudeen, a Philippine based online peer-to-peer marketplace for receivable discounting.

SME borrowers and investors can leverage on the strengths of both platforms for their financing and investment needs, while being able to enjoy exclusive...

Featurespace, an international provider of Adaptive Behavioural Analytics for fraud detection and risk management, has launched anti-fraud technology in Singapore. The company is working with 17 banks across continental Europe, the UK, US and Latin America. Their technology is also being embedded by payment processors and merchant...

SEEDS Capital, the investment arm of Enterprise Singapore, has appointed seven co-investment partners under Startup SG Equity. This will catalyse more than S$90 million worth of investments to develop Singapore-based startups in the Agrifood tech sector. This was announced by Senior Minister of State for Trade and...

Hong Kong-based finance advisory company Index-Asia has partnered with local financial consultancy firm UpSmart Strategy Consulting to help Philippine startups, small and medium enterprises (SMEs) and family businesses strengthen their capital-raising strategies.

The two companies said their partnership aimed to “create a growth strategy and structure their transactions and...