Singapore’s Central Bank, the Monetary Authority of Singapore (MAS), has warned members of the public not to be misled by fraudulent websites that solicit investments in cryptocurrencies using fabricated information attributed to the Singapore Government.

These websites falsely claim that Singapore is adopting a...

Hong Kong-based finance advisory company Index-Asia has partnered with local financial consultancy firm UpSmart Strategy Consulting to help Philippine startups, small and medium enterprises (SMEs) and family businesses strengthen their capital-raising strategies.

The two companies said their partnership aimed to “create a growth strategy and structure their transactions and...

In a significant revamp of accountancy regulations, auditors will come under greater scrutiny according to new proposals put forward by the Singapore Exchange Regulation (SGX RegCo). The latter will order a second audit on listed companies with clean audits if something does not seem right.

The Singapore Business Federation (SBF) SME Committee (SMEC) submitted its recommendations for the Singapore Budget 2019 to the government earlier this month.In 2018, the Singapore economy grew 3.3%, in line with the Ministry of Trade and Industry’s (MTI’s) forecast of 3.0% to 3.5%. Moving forward, MTI forecasts...

SEEDS Capital, the investment arm of Enterprise Singapore, has appointed seven co-investment partners under Startup SG Equity. This will catalyse more than S$90 million worth of investments to develop Singapore-based startups in the Agrifood tech sector. This was announced by Senior Minister of State for Trade and...

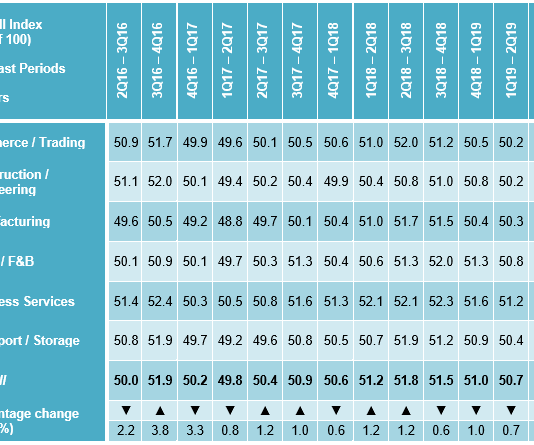

Singapore SMEs continue to adopt a mildly optimistic outlook for the first six months of 2019 as general sentiments eased across all seven sectors.The SBF-DP SME Index (the Index) decreased from 51.0 to 50.7 this quarter, indicating a slight dampening of sentiments among SMEs. This index is...

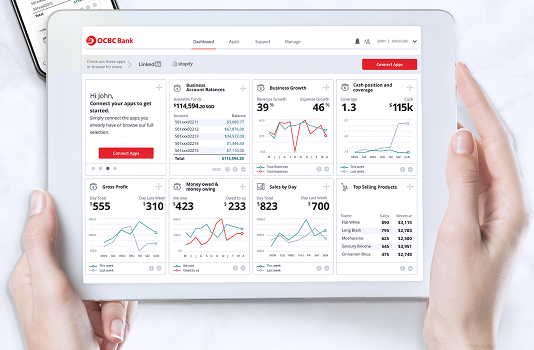

Financial services and banking services corporation OCBC Bank has launched a digital business dashboard for SME customers. Saving SMEs time, the one-stop dashboard gives a holistic view of an SME's business, transforming data from some of the most popular digital apps such as Facebook, PayPal, Mailchimp, Shopify...

SeedIn, a Singapore based business financing platform, has teamed up with Acudeen, a Philippine based online peer-to-peer marketplace for receivable discounting.

SME borrowers and investors can leverage on the strengths of both platforms for their financing and investment needs, while being able to enjoy exclusive...

In a bid to help SMEs in their digital transformation journey, banking and financial services corporation DBS has recently launched DBS SME Connect, a portal for SMEs across all industries to access web-based business tools and services to get digital, connected and protected fast. SMEs who are...

Business owners of small to medium size enterprises (SMEs) can now purchase commercial insurance tailored to their business needs online with Etiqa Insurance Singapore. The digital insurer has recently launched the Business Owners Super Suite (BOSS), which allows business owners and Etiqa’s agents to get commercial insurance...