This article was contributed by the Inland Revenue Authority of Singapore (IRAS).

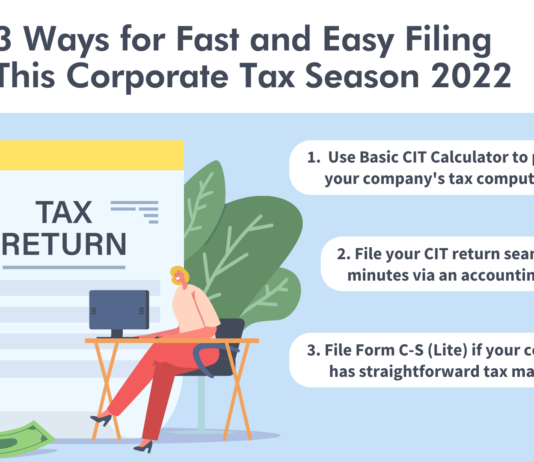

Corporate Income Tax (CIT) filing deadline is around the corner – all companies will need to file their CIT Returns (Form C-S/ Form C-S (Lite)/ Form C) for the Year of Assessment...

Start-ups, Small and Medium Enterprises (SMEs), and youth will get more resources to innovate using their Intellectual Property (IP).

They will be able to tap on free IP legal advice, patent drafting and/or prosecution services, resources, and training.

A release...

Digitalising paper invoicing across Southeast Asia’s millions of small and medium sized enterprises (SMEs) is a major opportunity in the post-COVID era as economies ramp up digital transformation efforts to better weather future shocks.

Finance departments serve a fundamental role in every company, processing...

Vietnamese small businesses retained their crown as the most likely in the Asia-Pacific to invest in technology in 2021, according to a survey by CPA Australia.This focus on technology was partially in response to the pandemic, with Vietnam's small businesses being the most likely to increase their...

ESG and sustainability issues alike have been moving up the corporate agenda in recent years. According to Google Search Trend, the keyword 'ESG' search popularity in Hong Kong has been soaring and surpassed 'Sustainability' in May this year.

However, public curiosity about the topic...

The Monetary Authority of Singapore (MAS), in partnership with the International Finance Corporation (IFC) and the United Nations Development Programme (UNDP), have launched an open financial education and action programme for micro, small and medium enterprises (MSMEs) in Asia and Africa.

Known as the...

COVID-19 has exacerbated income inequalities and social disparities across Asia, serving as a force multiplier for trends already in place.

A new social impact study released by the Centre for Asian Philanthropy and Society (CAPS) shows how to maximize philanthropic and policy responses to cope...

This article was contributed by the Inland Revenue Authority of Singapore (IRAS).

As the Goods and Services Tax (GST) will be raised from 7% to 8% with effect from 1 Jan 2023, the Inland Revenue Authority of Singapore (IRAS) encourages all GST-registered businesses to...

EngageRocket, in partnership with NTUC U WAF, released results from a survey conducted amongst 3,332 employees in Singapore across 10 industries. The survey focused on the state of work-life harmony in workplaces in Singapore.

The definition of work-life balance has changed in the last...

The Singapore Business Federation (SBF) published a manpower policy paper in May 2022 recommending nine action steps to support the manpower needs of the Lifestyle Services, Environmental Services, and Estate & Facilities Management (EFM) Services industries.

Titled, “The Human Touch: Balancing Manpower Resilience with...