This article was contributed by the Inland Revenue Authority of Singapore (IRAS).

Whether you are going through the GST rate change for the first time as a newly GST-registered business or are looking for a refresher to transit smoothly ahead of the second GST rate change, the Inland Revenue Authority of Singapore (IRAS) has put together a summary guide on how your business can get ready for the upcoming GST rate change.

Read on to learn about what you need to prepare, the common errors to avoid as well as digital solutions that you can tap on to ease your transition to the 2024 GST changes.

1. New GST Rate of 9% in 2024

Come 1 Jan 2024, the GST rate will be raised from 8% to 9%, as part of the two-step GST rate change announced by the Minister for Finance in Budget 2022. The first step from 7% to 8% had taken place earlier on 1 Jan 2023. The revenue collected from the increase in GST will go towards supporting our healthcare expenditure, and to take care of our seniors.

All GST-registered businesses should start their preparations early to ensure a smooth transition to the new 9% GST rate.

2. Three Key Things to Prepare

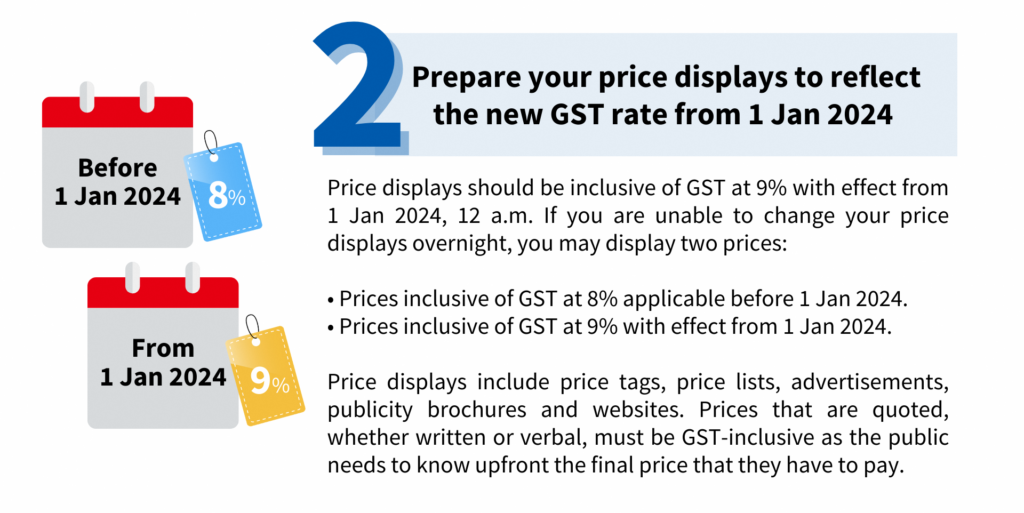

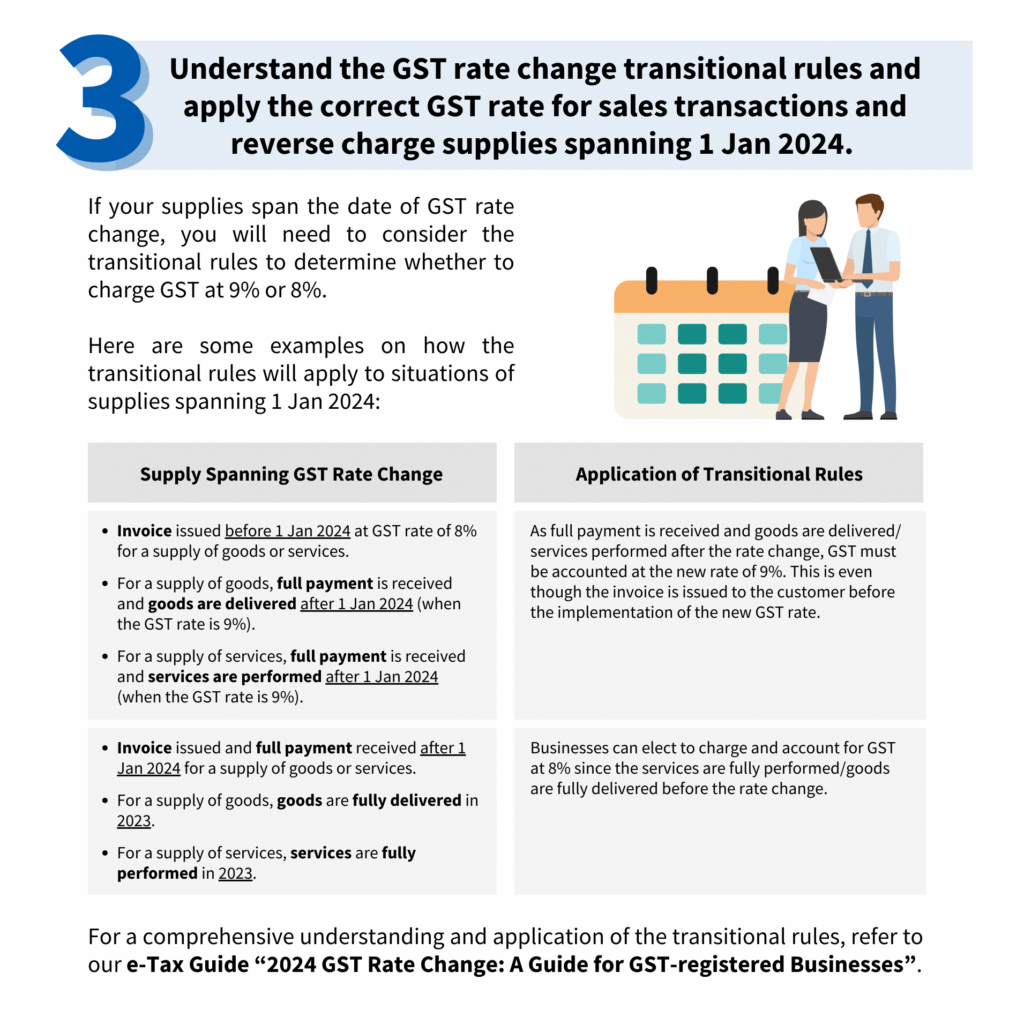

Use the checklist on the IRAS website to check if your business is ready for the GST rate change. Here are three key areas you need to prepare to transit smoothly to the new rate:

3. Three Common Rate Change Errors to Avoid

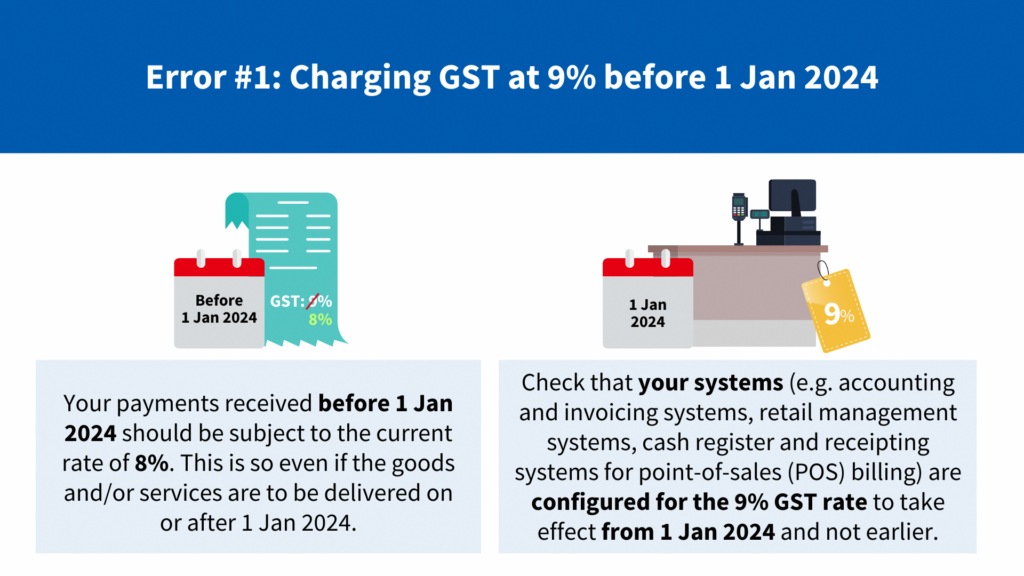

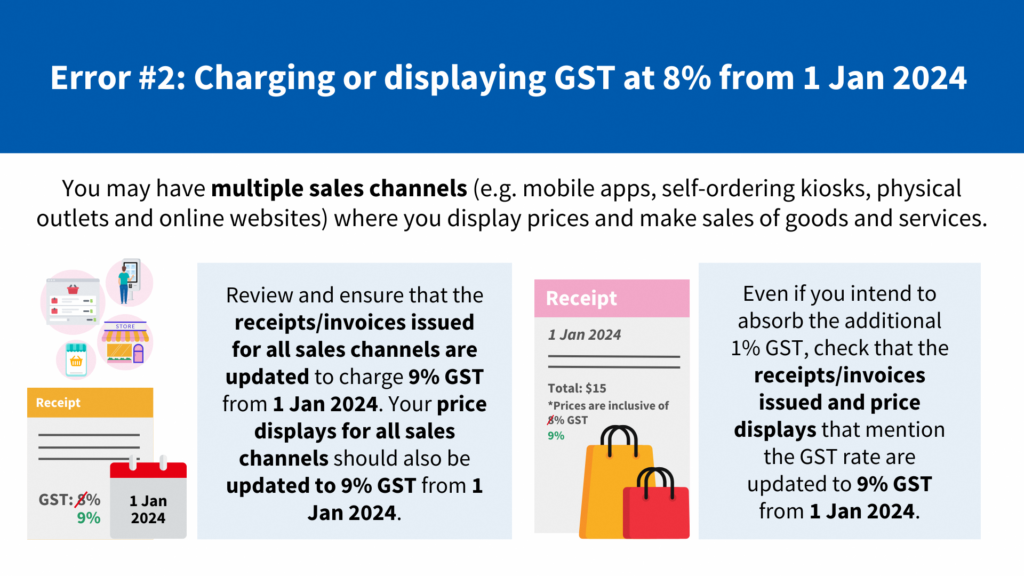

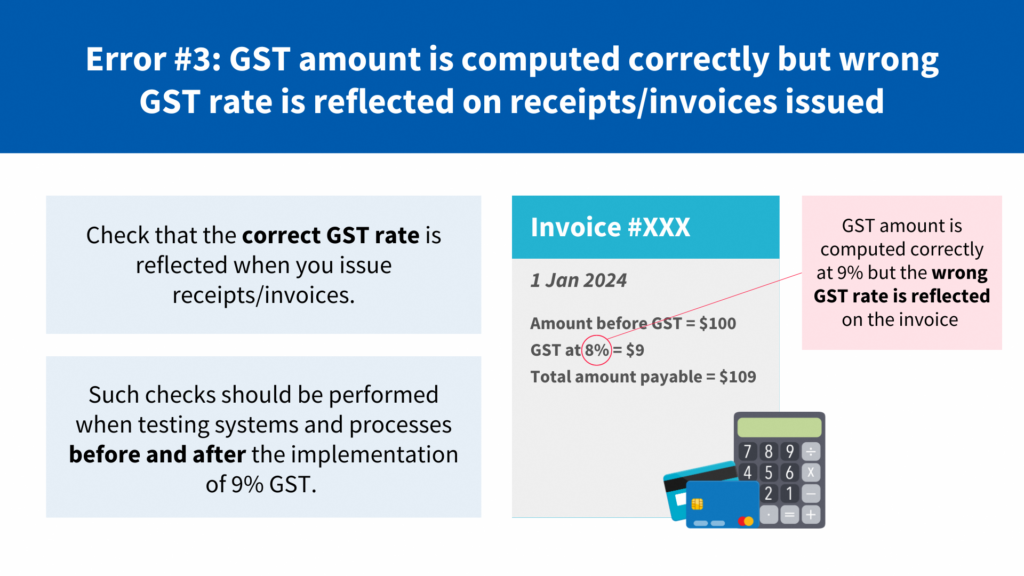

During the first step of the GST rate change, some common rate change errors were observed to be made by a small minority of businesses. Check out the common errors below to avoid committing them as you prepare your business for the second step of the rate change:

4. Ease of GST Rate Change Implementation with Digital Solutions

As you prepare to transit your business to the new GST rate, consider taking this opportunity to explore digital solutions for your business’ accounting and retail management needs. Adopting these digital solutions will also help your business to simplify record-keeping and comply with tax obligations more easily in the long run.

For the list of accounting software that meet IRAS’ technical requirements, please refer to the IRAS Accounting Software Register Plus. Some of the software may also qualify for funding support under the Productivity Solutions Grant. More information on the eligibility criteria and application process for the grant can be found on the GoBusiness website.

5. Communicating Reasons for Price/Fee Increase to Consumers

In the first step of the GST rate change, some businesses made the decision to increase prices or services fees to account for the 1% point GST rate increase and higher raw material and overhead costs. However, some had attributed the increase primarily or solely to the increase in GST.

As we approach the second step of the GST rate change, the Government would like to remind all businesses to communicate reasons for any price increases transparently with consumers. If your business is planning to implement price increases, be sure to provide clear explanations for the reasons behind them. Avoid misleading consumers to think that the price hikes are primarily or solely due to the increase in GST.

The Committee Against Profiteering takes a serious view of any unjustified price increases using the GST increase as an excuse and will investigate all feedback on such cases.

6. Key Considerations Before Voluntarily Registering for GST

If your business is not registered for GST yet, please note that you will be required to register when your business’ taxable turnover exceeds S$1 million at the end of the calendar year or if at any point of time you can reasonably expect your business’ turnover to exceed S$1 million in the next 12 months.

If your business is currently non-GST registered but you wish to register for GST voluntarily to claim the GST incurred on your purchases, you are advised to evaluate your business scenarios and your business costs (including the costs of complying with GST obligations) before making the decision.

Watch this video for further elaboration on the factors you should consider before registering for GST.

7. Useful Resources on GST Rate Change

To ensure your business can enjoy a smooth transition to the new GST rate, tap on the following self-help resources prepared by IRAS:

- 2024 GST Rate Change e-Tax Guide

- Frequently asked questions on the correct GST rate to charge under common business scenarios for supplies spanning the rate change date as well as other rate change related questions.

- YouTube Video on preparing for GST Rate Change.

Read through our resources for GST Rate Change and still have questions? You may sign up for the live webinar sessions conducted by IRAS here.

For more information on the GST rate change, visit www.go.gov.sg/irasgst-rc-businesses.